Argon, a noble gas constituting approximately 0.93% of the Earth's atmosphere, is widely used in various industries, including electronics, welding, metal fabrication, lighting, and the medical sector. The global demand for argon has steadily increased due to its indispensable role in industrial processes. This article delves into the argon price trend, exploring key factors influencing its market value, historical fluctuations, and future outlook.

Understanding Argon and Its Market Significance

Argon is an inert gas, making it highly suitable for shielding applications in welding and metal production. It is extracted as a byproduct of oxygen and nitrogen production in cryogenic air separation units (ASUs). Due to its unique properties, the gas finds applications in various high-tech industries, including semiconductors, aerospace, and lighting solutions.

Key Uses of Argon:

Welding and Metal Fabrication: Argon is commonly used as a shielding gas in arc welding processes, particularly for stainless steel and aluminum.

Electronics and Semiconductor Industry: The gas is essential in the manufacturing of semiconductors and microelectronics due to its inert nature.

Aerospace Industry: Used in the production of high-performance alloys and specialized equipment.

Lighting Industry: Plays a role in the production of energy-efficient lighting systems, including neon and incandescent bulbs.

Medical Applications: Used in cryosurgery and medical research laboratories.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/argon-price-trends/pricerequest

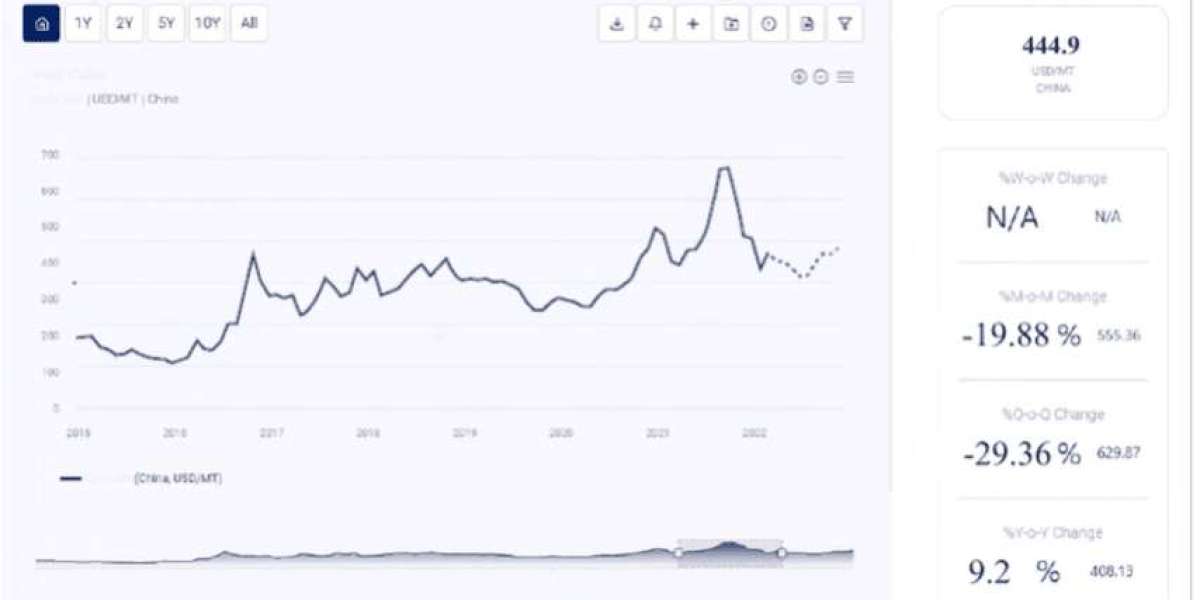

Historical Argon Price Trends

The price trend of argon has seen significant variations over the years due to fluctuations in industrial demand, supply chain constraints, and geopolitical factors. Several factors influence the cost of argon, including:

Raw Material and Production Costs: Since argon is a byproduct of air separation, fluctuations in oxygen and nitrogen production impact its availability and price.

Energy Costs: The cryogenic distillation process used to extract argon is energy-intensive. Thus, rising electricity and fuel costs contribute to price variations.

Supply Chain and Transportation Costs: The price of argon can also be affected by logistics, including storage, transportation, and handling expenses.

Geopolitical and Trade Policies: Restrictions on industrial gas trade, environmental regulations, and geopolitical tensions can affect the global supply of argon.

Demand Fluctuations in Key Industries: As industries such as electronics and aerospace expand, the demand for argon rises, leading to price changes.

Regional Analysis of Argon Prices

The price trend of argon varies across regions due to differences in industrialization levels, production capabilities, and market demand. Below is an analysis of the regional argon market:

North America

The U.S. and Canada have well-established industrial gas markets, with steady demand from the automotive, semiconductor, and healthcare sectors.

Prices in this region are influenced by fluctuations in energy costs and technological advancements in air separation techniques.

Europe

The European market experiences relatively stable argon prices due to its advanced industrial gas sector and strict environmental regulations.

Germany, France, and the U.K. are major consumers due to their automotive and aerospace industries.

Asia-Pacific

This region has the fastest-growing argon market, driven by rapid industrialization in China, India, South Korea, and Japan.

Increasing investments in electronics, manufacturing, and steel production have led to higher argon consumption.

Supply chain disruptions and energy costs impact price fluctuations.

Middle East & Africa

The demand for argon in this region is growing, especially in the oil & gas and construction industries.

Limited local production results in reliance on imports, leading to price volatility.

Factors Driving Future Argon Price Trends

With global industrial growth and technological advancements, the demand for argon is expected to continue increasing. Below are some key drivers shaping the future price trend of argon:

1. Expansion of the Semiconductor Industry

The growing demand for microchips and semiconductors fuels the need for high-purity argon in manufacturing.

As technology advances, new applications for argon in quantum computing and nanotechnology are emerging.

2. Increased Use in Metal Production and Welding

The rise in construction and infrastructure projects will boost demand for argon in metal fabrication.

The automotive industry’s transition towards electric vehicles (EVs) also contributes to increasing argon consumption.

3. Energy Transition and Renewable Energy Growth

As industries move towards hydrogen production and green energy, the need for argon in cooling and storage applications will rise.

Cryogenic applications in liquefied natural gas (LNG) production will further drive demand.

4. Advancements in Air Separation Technologies

Improved air separation unit (ASU) efficiency and new gas recovery techniques may stabilize prices and ensure consistent supply.

5. Environmental Regulations and Sustainability Trends

Stricter environmental policies may impact production costs, but also drive innovations in low-carbon air separation methods.

The push for carbon capture and storage (CCS) projects may create additional demand for argon in related applications.

Challenges and Risks in the Argon Market

Despite the strong growth outlook, certain challenges and risks could impact the price trend of argon:

Supply Chain Disruptions: Logistics issues, geopolitical tensions, and labor shortages can lead to supply constraints.

High Production Costs: The energy-intensive nature of argon production means that fluctuations in electricity and fuel prices directly impact costs.

Competition from Alternative Technologies: The development of alternative shielding gases in welding or new semiconductor manufacturing processes may reduce argon demand.

Market Volatility in Raw Material Availability: Since argon is produced as a byproduct, any reduction in oxygen or nitrogen production will directly affect argon supply.

The future of argon prices will be influenced by a combination of industrial demand, production advancements, and global economic conditions. With growing applications in semiconductors, aerospace, and green energy technologies, the demand for high-purity argon is expected to rise. However, supply chain constraints, production costs, and geopolitical factors will continue to impact price stability.

Businesses relying on argon should focus on long-term procurement strategies, energy-efficient technologies, and sustainable production methods to mitigate price volatility. As the market evolves, staying informed about industry trends will be crucial for making strategic investment and supply chain decisions.

This article provides an in-depth analysis of argon price trends, key market drivers, regional analysis, and future outlook. For those seeking detailed market reports and cost analysis, Procurement Resource offers comprehensive industry insights to support business decisions.

Contact Information

Procurement Resource

Website: https://www.procurementresource.com

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

- UK: +44 7537171117

- USA: +1 307 363 1045

- Asia-Pacific (APAC): +91 1203185500

For more information, visit our website or contact our sales team at sales@procurementresource.com