The financial industry is undergoing a massive digital shift, and Non-Banking Financial Companies (NBFCs) must embrace advanced technology to stay competitive. Managing lending, compliance, and risk assessment manually is no longer viable. This is where best NBFC software comes in—a game-changer for financial institutions looking to optimize operations, enhance customer experience, and ensure regulatory compliance.

Why NBFCs Need a Digital-First Approach

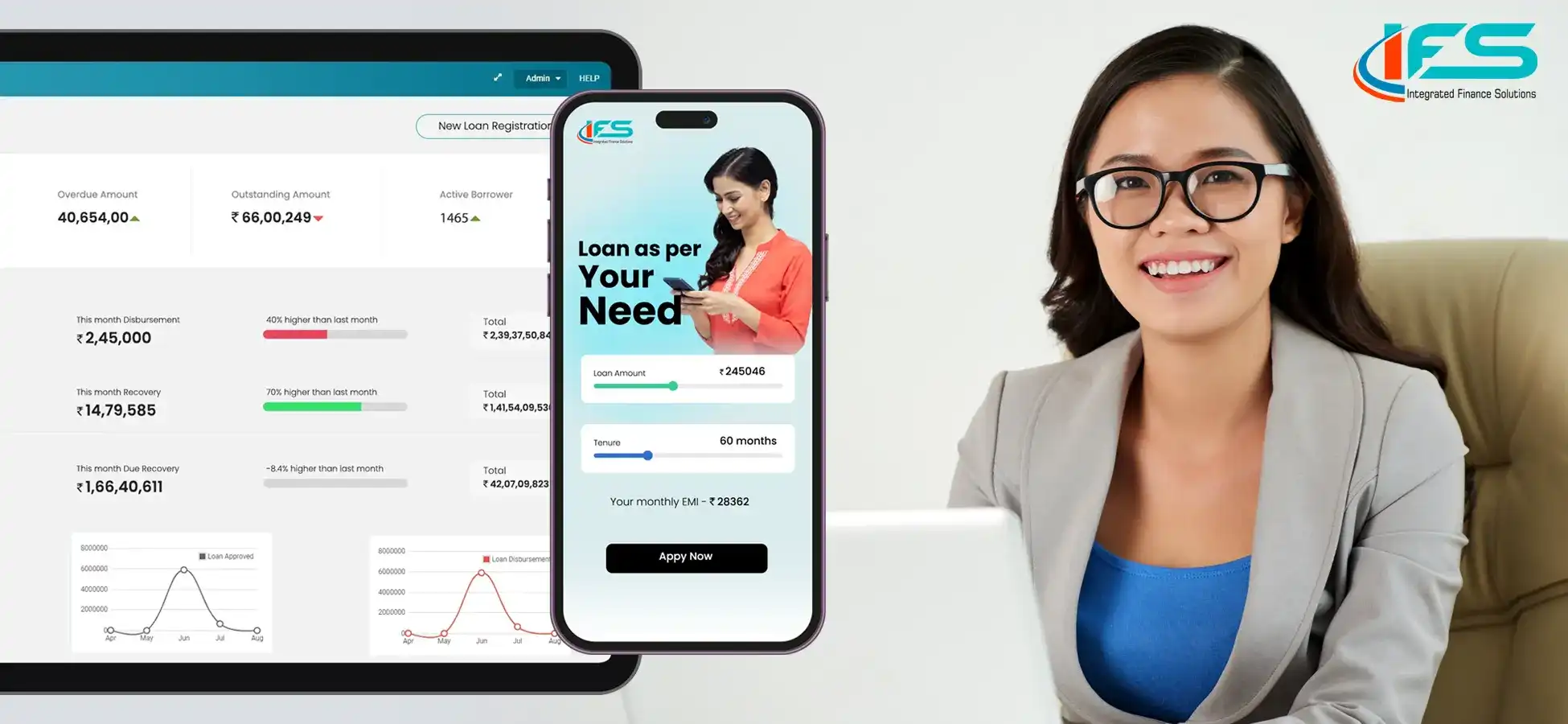

With increasing demand for faster loan processing and secure financial transactions, relying on traditional banking methods can slow down growth. NBFC software solutions automate critical processes, reducing operational risks while improving efficiency. Whether it’s a startup NBFC or a large-scale financial enterprise, implementing the best software for NBFC is key to sustainable success.

Key Features of a Robust NBFC Software Solution

Automated Loan Management

A fully digital loan lifecycle—from application to disbursement—ensures faster processing and eliminates paperwork delays.

AI-Driven Credit Risk Analysis

Advanced algorithms assess borrower risk in real time, improving decision-making and reducing default rates.

Regulatory Compliance Automation

Stay ahead of ever-changing regulations with built-in compliance tracking, automated reporting, and fraud detection tools.

Cloud-Based Infrastructure

Access data securely from anywhere, ensuring scalability and seamless business expansion.

Customer-Centric Digital Experience

With integrated best NBFC software, lenders can offer personalized financial solutions, enhancing customer engagement.

Choosing the Right NBFC Software Provider

Selecting a NBFC software provider that aligns with your business needs is crucial. A reliable provider offers tailored NBFC software solutions, ensuring smooth integration with core banking systems, payment gateways, and third-party financial services.

Future of NBFC Technology: What’s Next?

With advancements in advanced NBFC software, the future of non-banking finance is moving towards:

Blockchain-powered transactions for enhanced security.

AI-based predictive analytics for better lending strategies.

Mobile-first financial solutions for seamless accessibility.

Upgrade to the Best NBFC Software Today

A technology-driven approach is essential for NBFCs looking to scale efficiently. Investing in NBFC software provider solutions will not only improve operational performance but also build trust among borrowers.