For many families, inheriting land in Michigan is both a privilege and a responsibility. However, when it comes time to sell, the process can be complex, involving legal considerations, tax implications, and emotional ties. Whether the land has been passed down through generations or remains unused, selling it requires strategic planning. This guide outlines everything you need to know to navigate the sale smoothly.

1. Establishing Ownership Before Selling

Before listing the land for sale, ensure that the title is legally in your name. In Michigan, this often involves going through probate, a legal process that validates wills and settles estates. If the land was owned jointly or placed in a trust, ownership may transfer automatically. Otherwise, you’ll need to navigate probate court, which can take several months depending on the estate’s complexity.

Key Takeaways

- Confirm ownership – If the land is inherited, establish legal ownership through probate.

- Determine the land’s value – Get an appraisal or market analysis to set a competitive price.

- Understand tax obligations – Be aware of capital gains tax and other liabilities.

- Prepare the property for sale – Clean up the land and gather necessary documents.

- Choose the right selling method – Decide between working with an agent, selling independently, or opting for a land-buying company.

- Seek professional guidance – Consult real estate, legal, and tax experts to avoid complications.

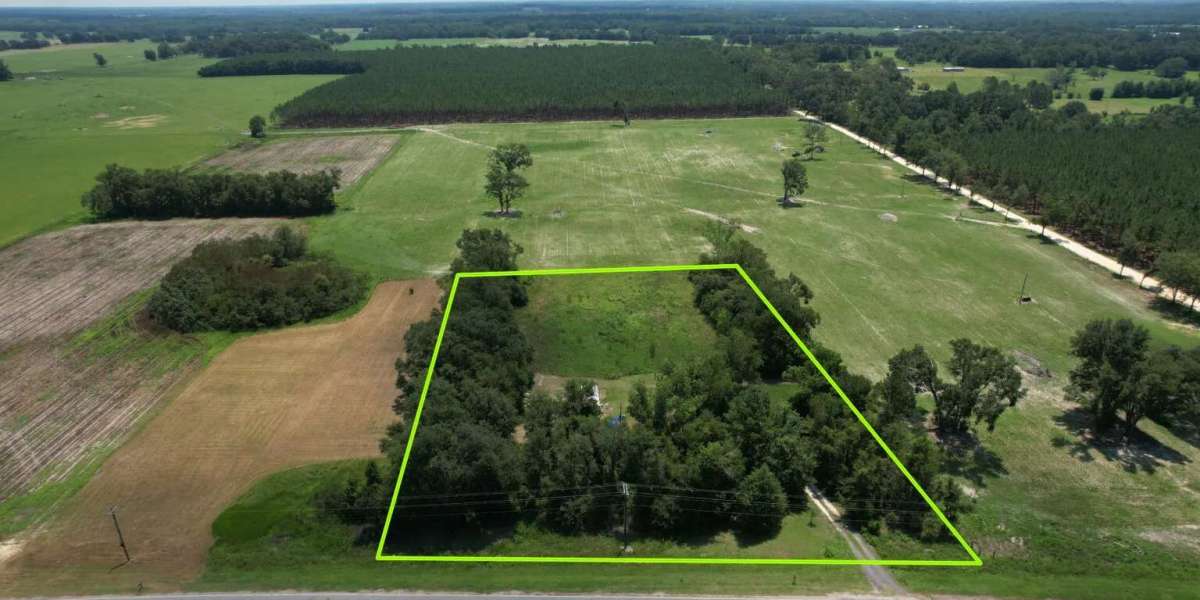

2. Determining the Land’s Market Value

To set a competitive and fair selling price, you need an accurate valuation of your property. There are two main approaches:

- Professional Appraisal – A licensed appraiser assesses the land based on its size, location, zoning regulations, and market trends.

- Comparative Market Analysis (CMA) – A real estate agent evaluates recent sales of similar properties to estimate your land’s market value.

Accurate pricing is essential, as overpricing can deter buyers while underpricing may lead to financial loss.

3. Understanding Tax Considerations

Selling inherited land comes with tax implications, but understanding them can help you minimize costs.

- Capital Gains Tax – The good news is that inherited properties receive a step-up in basis, meaning the land’s value is adjusted to its worth at the time of inheritance. This reduces the taxable gain when you sell.

- Estate Tax – Michigan does not have an estate tax, but federal taxes may apply to large estates.

- Property Taxes – Check if any outstanding property taxes are owed before finalizing the sale.

Consulting a tax professional ensures compliance and helps you explore potential deductions or exemptions.

4. Preparing the Land for Sale

Making the property more appealing can increase its marketability. Here’s how:

- Clear the Title – Ensure there are no ownership disputes or liens against the property.

- Improve Curb Appeal – Basic maintenance, such as clearing overgrown vegetation or addressing environmental concerns, can make the land more attractive.

- Organize Documentation – Have legal papers ready, including land surveys, zoning permits, and records of easements.

Buyers appreciate transparency, and well-prepared documentation can speed up the transaction.

5. Exploring Selling Options

Different selling methods offer unique advantages. Choose the one that best suits your situation:

- Real Estate Agent – Agents handle marketing, negotiations, and paperwork, but charge commission fees.

- For Sale By Owner (FSBO) – Selling independently saves on fees but requires effort in advertising and negotiations.

- Land Buying Companies – These companies purchase land directly, often providing quick cash offers with minimal hassle.

Each approach has pros and cons, so weigh your options carefully before proceeding.

6. Considering a Land Contract Sale

Michigan allows land contracts, where the buyer makes payments over time rather than purchasing the property upfront. The deed transfers only after the final payment is made. This option can attract buyers who may not qualify for traditional loans and can result in a steady income stream for the seller.

7. Handling Family Disagreements

Inherited land often has multiple stakeholders, and not all family members may agree on selling. To prevent conflicts:

- Communicate openly – Hold discussions to address concerns and align on decisions.

- Consider mediation – A neutral third party can help resolve disagreements.

- Understand legal options – If disputes persist, legal intervention may be necessary to facilitate a resolution.

Navigating family dynamics with transparency and fairness helps ensure a smooth selling process.

8. Seeking Professional Assistance

Consulting experts can prevent costly mistakes:

- Real Estate Attorney – Ensures all legal documents are in order and protects your interests.

- Tax Professional – Helps minimize tax liabilities and ensures compliance.

- Land Specialist Realtor – Provides insights specific to selling vacant land in Michigan.

Working with experienced professionals streamlines the process and helps you avoid common pitfalls.

Conclusion

Selling family-owned land in Michigan requires careful planning and informed decision-making. By ensuring legal ownership, understanding market value, addressing tax considerations, and selecting the best sales approach, you can maximize your return while respecting your family’s legacy. Consulting experts further simplify the process, ensuring a smooth and successful sale.

FAQs

How long does probate take in Michigan?

Probate typically takes anywhere from seven months to a year, depending on the complexity of the estate.

Do I need to pay inheritance tax in Michigan?

No, Michigan does not impose an inheritance tax. However, federal taxes may apply to large estates.

Can I sell the property if I co-own it with other family members?

Yes, but all co-owners must agree on the sale. If disagreements arise, legal action may be needed to partition the property.

What does “step-up in basis” mean?

This tax rule adjusts the property's value to its market worth at the time of inheritance, reducing capital gains tax when selling.