North America Green Hydrogen Prices Movement Q4:

Green Hydrogen Prices in the United States:

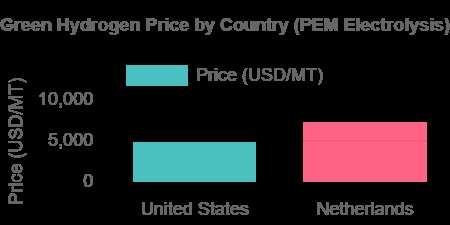

Late 2024 saw the Green Hydrogen Prices in the USA register a major spike, up to 5,372 USD/MT (PEM Electrolysis) in December. This was mostly caused by increased natural gas prices, which significantly influence hydrogen production costs. Also, the increased usage of fuel cell vehicles (FCVs) and the increase in demand for green hydrogen for transportation purposes contributed to price escalation. Even with continued attempts to boost production efficiency and raise capacity, demand in the market remained higher than supply, holding prices higher. As shown in the Green Hydrogen Price History, these have been responsible for a continued increase in prices, revealing the industry's growing dependence on clean energy solutions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/green-hydrogen-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Europe Green Hydrogen Prices Movement Q4:

Green Hydrogen Prices in the Netherlands:

During late 2024, the Green Hydrogen Prices in Netherlands registered a dramatic increase to 7,783 USD/MT (PEM Electrolysis) in December. This was led primarily by the nation's stepped-up switch to renewable energy and biofuels in its approach to decarbonization. Secondly, heavy investments in hydrogen infrastructure, such as increased import capacity and distribution networks, also fueled price increases. Pivotal government initiatives and the regulatory environment also contributed significantly to the stimulation of market growth and maintaining demand in major industries. As shown in the Green Hydrogen Price History, they all contributed cumulatively towards the rising trend in prices that further solidified the Netherlands' resolve towards cleaner energy in the future.

Regional Analysis: The price analysis can be expanded to include detailed green hydrogen price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

What is the Future Price of Green Hydrogen?

The future price of green hydrogen is expected to decline steadily as production technologies improve, renewable energy costs drop, and global demand increases. With ongoing investments and scaling of electrolyzer capacity, green hydrogen is projected to become more competitive, positioning itself as a key clean energy solution in the years ahead.

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors Influencing Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Green Hydrogen Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of Green Hydrogen price trend, offering key insights into global Green Hydrogen market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Green Hydrogen demand, illustrating how consumer behaviours and industrial needs affect overall market dynamics. The price report uncovers critical factors influencing current and future prices by exploring the intricate relationship between supply and demand.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, the Middle East, and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145