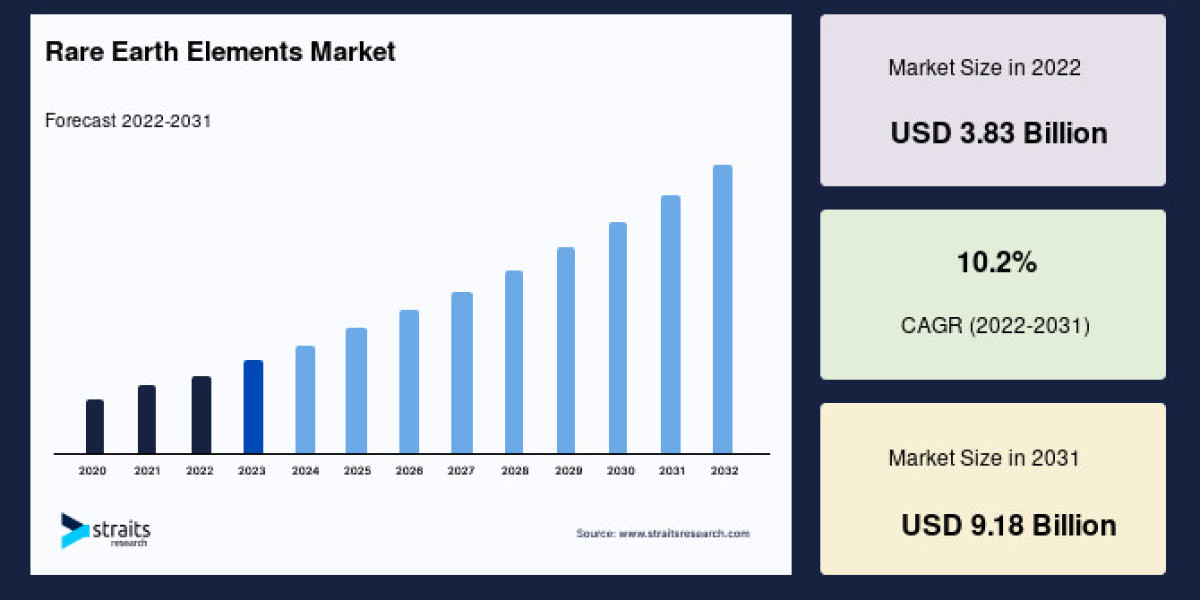

The global Rare Earth Elements Market, valued at USD 3.83 billion in 2022, is projected to achieve an impressive USD 9.18 billion by 2031, registering a robust compound annual growth rate (CAGR) of 10.2% during the forecast period from 2023 to 2031. Rare earth elements (REEs), consisting of 17 metallic elements, are essential for numerous high-tech applications due to their unique properties, including catalytic, metallurgical, nuclear, magnetic, and luminescent characteristics. Their rising demand is attributed to increased adoption in green technologies, electronics, and the aerospace sector.

Get PDF Sample Report Now! : https://straitsresearch.com/report/rare-earth-elements-market/request-sample

Scope of the Market

Rare earth elements have become indispensable for a wide range of industries, including electronics, automotive, aerospace, and renewable energy. They are critical components in electric vehicles, wind turbines, smartphones, and catalytic converters. Furthermore, their role in advancing green technologies, such as wind energy systems and electric mobility, positions REEs as key enablers of sustainable growth.

Market Segmentation

By Element:

- Cerium (oxide, sulfide, and other compounds)

- Neodymium (alloy)

- Lanthanum (alloy, oxide, and others)

- Dysprosium

- Terbium

- Yttrium

- Scandium

- Other elements

By Application:

- Catalysts

- Glass and Polishing

- Ceramics

- Phosphors

- Metallurgy

- Magnets

- Other applications

Get Free Sample Report for Detailed Market Insights : https://straitsresearch.com/report/rare-earth-elements-market/request-sample

Regional Analysis

The Asia-Pacific region dominates the global market and is expected to maintain its leadership with a CAGR of 4.7% during the forecast period. China, the world’s leading producer and processor of REEs, supplies over 60% of global rare earth elements, making it a cornerstone of the industry. Additionally, increasing smartphone adoption, electric vehicle production, and wind energy installations are driving growth in this region.

Europe emerges as the fastest-growing market, fueled by advancements in the automotive and green energy sectors. Germany, a major player in electric vehicle manufacturing, plays a pivotal role in boosting demand for REEs.

Key Players

- Aluminum Corporation of China Ltd

- Lynas Rare Earths Ltd

- Rio Tinto

- Avalon Advanced Materials Inc.

- Northern Minerals

- Peak Resources

- Shin-Etsu Chemical Co. Ltd

- Ucore Rare Metals Inc.

Conclusion

As the world accelerates its transition to green technologies and advanced manufacturing, the demand for rare earth elements is expected to witness unprecedented growth. The market's expansion is driven by advancements in electric mobility, renewable energy, and aerospace, making it a cornerstone for sustainable innovation.